This article will attempt to provide some basic information related to retirement planning. The Fidelity website has a lot of good information, diverse investment options, and was the 401(k) provider of a former employer, so it is used is most examples. This article is not an endorsement of an service company or investment option. Do your own research, make a plan, and follow it.

Take Control of Your Finances

The first rule of remaining solvent is to spend less than you make. If you spend more than you make, you get stressed, go bankrupt, and fail to save. This does not mean that you should buy stuff and not pay for it. It means that your left over money is used for non-essentials. If you can not pay for essentials and pay yourself, find a way to (legally) make more money. If you do not already have or do these four things, you should be doing them. These are best practices for financial health.

- use term life insurance for income protection

- reduce or eliminate junk debt

- build a 3 to 6 month emergency fund

- build retirement savings

A budget is a powerful tool. Creating and following a budget will help you succeed, but many people do not have the discipline or patience to do this. To succeed without a budget, you need to

- pay yourself first

- spend less than you earn

If your credit card burns a hole in your pocket because it is not maxed out, you need to burn the credit card and pay with cash. If you do not have the cash, you can not buy it. Pay yourself first does not mean that you should not pay your bills. It means that your retirement savings come out of your check first (well, after your employer takes out taxes, social security, medicare, and health insurance) and what is left has to cover your bills and discretionary spending.

There are resources on the internet that talk about this topic in detail. Different service providers often focus on different aspects of financial health. Fidelity has a Financial Basics page that has useful information, and your preferred search engine will lead you to others. Read several sources on financial health rather than just one because many resources bias the information with the agenda of getting you as a customer.

Life Insurance

Life insurance should be called income insurance or expense insurance. The point of life insurance is to make sure your family does not struggle when someone they depend on passes away. If no one depends on your income, no one depends on your work, or your assets are sufficient, you do not need life insurance. If someone depends on your income or the work you do, life insurance can protect the survivors in your absence. Your partner may not get paid for their work, but if they care for children, make meals, and clean, you may have to pay someone to do that in their absence.

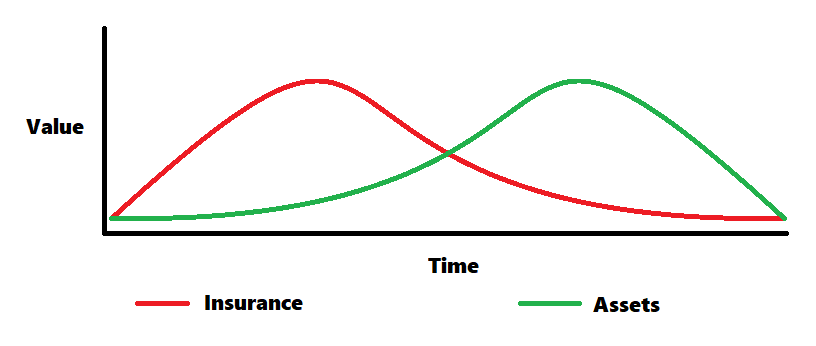

When you are young with no partner or dependents, you should not need much insurance. As you age, grow a family, and take on debt, your insurance requirements increase with your responsibilities. As your assets grow and your responsibility declines, you need less insurance to protect your family. In general, life insurance benefits should quickly rise to a peak and slowly decline as you age. As shown below, the insurance curve and asset curve tend to mirror each other.

There are plenty of sources on the internet to calculate appropriate coverage values in different ways. A few of the simpler ways are to use either

- Annual benefit x The number of years needed

- (10 to 12) x Annual benefit

You will see numbers like 10x to 12x again in the retirement savings section. That 10x-12x might be on the low side. If you invest with a balanced rate of return, 10x an annual salary or cost will pay the annual amount every year for about 10 years. If your partner with no income dies at 25 leaving you with small children, 10-12 years might not be long enough. (This is not linear, 15x lasts almost 20 years, 20x lasts almost 30 years, 25x lasts more than 40 years.) If you have no children and your partner has income, the supplemental income from 10x-12x your salary may be just fine.

Term life insurance is typically sold in 10, 20, and 30 year terms. Depending on your responsibilities and career, you could easily need 30 to 50 years of life insurance. For longer careers, you will need some combination of terms over time. At retirement time, you should have enough assets to self-insure.

Take the example 20 year old from the introduction. Initially, they might just need a small policy to cover debt and funeral expenses. If this person got married at 28 years old, they should get insurance to protect their partner and future children. If they planned to retire at 68 years old, their partner needs about 40 years of protection. If they made $50,000 per year, they have many options for life insurance arrangements. Here are three potential options and what is good and bad about them.

Option 1) 40 years x $50,000 per year: A $2 million policy for 40 years to cover the possible loss of their income for their entire career. This is guaranteed to be enough, and it could almost be put in a savings account. The insurance company may not be willing to insure them for 40x their salary. They would need to get it as a 30 year and 10 year or back-to-back 20 year policies. This is also vastly more expensive than they need because 25x salary will pay for more than 40 years of salary.

Option 2) 25 x $50,000 per year: A balanced investment of $1.25 million would replace 40 years of salary, with the same 30+10 year or 2x 20 year terms. This should be about 85% of the cost of the first option, but this is also more expensive than they need. At 48 years old, they only need to pay out for 20 more years, not 40 more years.

Option 3) Laddered 25 x $50,000 per year: A ladder of insurance policies is a better choice. This will provide a appropriately decreasing coverage that should have decreasing cost over time.

- At 20:

- (1x) $50,000 10-30 year term policy for debt and funeral expenses

- At 28:

- (4x) $200,000 10 year term policy

- (20x) $1,000,000 20 year term policy

- At 48:

- (6x) $300,000 10 year term policy

- (9x) $450,000 20 year term policy

If the lump sum benefit is put in a balanced investment, this ladder of life insurance policies will provide salary replacement for the entire 40 years. This should cost about 65% of the first options or 75% of the second option.

You should verify whether you have to reapply or can just purchase an additional term policy. If you are concerned about your health later in life, you could fail to get accepted for another term or your price could drastically increase when you reapply. The older you are, the more expensive the life insurance will be. Be aware that the insurance company is better at math than you. The choice of insurance terms are more about when you spend the money than how much total money you spend. On average, the insurance company always wins.

In all cases, you should be looking into term life insurance. Whole life insurance is more costly to you and less risk to the insurance company. If the life insurance policy “builds value” or is “permanent”, it is a variant of whole life insurance. In simple terms, whole life insurance merges your life insurance with an investment. In general, you are better off keeping your life insurance and investments separate.

Junk Debt

Your home mortgage is not junk debt. A loan for a reasonable commuting vehicle is not junk debt. A credit card used as a cash substitute that is paid off fully every month is not usually debt. Junk debt is typically considered to be high interest revolving debt. This tends to be many smaller value items and services that are paid off in installments over an extended period of time. If you do not fully pay off your credit card every month, it is probably junk debt. If it takes away from retirement savings, excessive luxury debt (e.g., boats, ATVs, jet skis, etc.) is a slightly different form of junk debt. Junk debt can cost you a lot of retirement money.

In the last few years, 5% interest has been possible in a wide variety of very safe investments. A 12% interest rate on a credit card is on the low side. If you bought a $1,200.00 TV on credit, you could pay $100 per month for 13 months to pay off $1,200.00 for that TV plus 84.78 in interest. Yes, you could take longer and pay even more for it, but that would make the example table really big. If you made $100 deposits into a 5% savings account for twelve months, you could buy the TV with cash and keep the $33.00 interest. That is a difference of $117.78. So what? I got the TV that I wanted when I wanted it. Remember the rule of 72? Using the same 20 year old retiring at 68, that $117.78 invested at 12% would be more than $25,000 at retirement. That $1,200.00 TV costs more than $20,000.00. Do that every year for 48 years, and it about $225,000.00 lost from retirement savings. If you make minimum payments, that TV takes 3 years to pay off and costs more than $45,000.00 from retirement savings. Even at a 9% return, you are losing out on $7,000 for the TV this year and about $80,000 for doing it every year until retirement.

| Month | 12% Credit Card | Credit Card Payment | 5% Savings Account | Savings Deposit |

|---|---|---|---|---|

| 0 | -$1200.00 | $0.00 | ||

| 1 | -$1112.00 | $100.00 | $100.00 | $100.00 |

| 2 | -$1023.12 | $100.00 | $200.42 | $100.00 |

| 3 | -$933.35 | $100.00 | $301.25 | $100.00 |

| 4 | -$842.68 | $100.00 | $402.51 | $100.00 |

| 5 | -$751.11 | $100.00 | $504.18 | $100.00 |

| 6 | -$658.62 | $100.00 | $606.29 | $100.00 |

| 7 | -$565.21 | $100.00 | $708.81 | $100.00 |

| 8 | -$470.86 | $100.00 | $811.76 | $100.00 |

| 9 | -$375.57 | $100.00 | $915.15 | $100.00 |

| 10 | -$279.33 | $100.00 | $1018.96 | $100.00 |

| 11 | -$182.12 | $100.00 | $1123.21 | $100.00 |

| 12 | -$83.94 | $100.00 | $1227.89 | $100.00 |

| 13 | $0.00 | $84.78 | $33.00 | -$1200.00 |

Small amounts of junk debt that are paid off quickly are not a significant problem. The national average credit card debt is $7,000.00. Depending on the card, paying with minimum payments could take 24 years and more than $6,500.00 in interest charges, assuming you do not keep adding to your debt. If you keep your 12% credit card at $7,000.00 for 48 years paying $840.00 per year, that could be a loss of about $1.6 million in retirement savings. A 12% return is possible, but it is a bit extreme. At a more realistic 9% return, it is only a loss of more than $575,000.00 in retirement savings.

For most people, it is critical to manage your junk debt in order to retire at a reasonable age.

Emergency Fund

Build up a 3 to 6 month emergency fund. This should be invested in something that is relatively stable because you need it to be there in emergencies. This is not your “buy a bigger TV” fund. This is your “I am in the hospital, and I do not want to lose my house” or “I lost my job, and I want to be able to feed my kids” fund. At a minimum, the emergency fund should be 3 to 6 months of your essential expenses. This includes expenses such as mortgage payments, car payments, your insurance (i.e., home, auto, life, and health), food, necessary utilities, and retirement savings. It can exclude discretionary expenses such as eating out, cable TV, NetFlix, Amazon Prime, and discretionary savings (e.g., monthly deposits for a vacation). This fund is to protect your life from disruption during an emergency such as loss of work or hospitalization. Instead of paying penalties for late payments or getting foreclosed, you will be getting interest or dividend payments on your savings.

Retirement Savings

Once the first three are taken care of, you should put a designated dollar amount or percentage into retirement savings on a regular interval. This practice is sometimes referred to as dollar cost averaging. It can reduce the average share price versus buying a fixed amount of shares on a regular interval. The more important aspect of this is that it allows you to leverage time in the market and removes emotion from investing. If you can, invest the majority of your pay raises into retirement before you get used to spending it. How much you need to invest and where to invest is discussed next.

Next: Retirement Savings